Collaborating

Researcher, Stanford University

Managing

Partner, Market Psychology Consulting

San Francisco, CA , USA

Telephone: 415.267.4880

Email: richard@peterson.net

Last updated January 3, 2005

Published in: Brain Research

Bulletin

The Neuroscience of Investing: FMRI of the reward system

Abstract

Functional magnetic resonance imaging has proven a useful tool for observing neural BOLD signal changes during complex cognitive and emotional tasks. Yet the meaning and applicability of the fMRI data being gathered is still largely unknown. The brain’s reward system underlies the fundamental neural processes of goal evaluation, preference formation, positive motivation, and choice behavior. FMRI technology allows researchers to dynamically visualize reward system processes. Experimenters can then correlate reward system BOLD activations with experimental behavior from carefully controlled experiments. In the SPAN lab at Stanford University, directed by Brian Knutson PhD, researchers have been using financial tasks during fMRI scanning to correlate emotion, behavior, and cognition with the reward system’s fundamental neural activations. One goal of the SPAN lab is the development of predictive models of behavior. In this paper we extrapolate our fMRI results toward understanding and predicting individual behavior in the uncertain and high-risk environment of the financial markets. The financial market price anomalies of “value versus glamour” and “momentum” may be real-world examples of reward system activation biasing collective behavior. On the individual level, the investor’s bias of overconfidence may similarly be related to reward system activation. We attempt to understand selected “irrational” investor behaviors and anomalous financial market price patterns through correlations with findings from fMRI research of the reward system.

Keywords

Behavioral finance, investor, market, neuroscience, fMRI

Introduction

Stock market bubbles and crashes, economic booms and busts, irrational financial decisions - what if these could be predicted and steps taken to prevent them? In recent years finance theory has been greatly enhanced by the study of investor psychology and behavior, and prominent scholars have suggested that many of the “irrationalities” demonstrated by individual investors may be related to neural substrates [22]. Neuroscience promises to further advance our knowledge of financial markets by discerning the fundamental neural processes that motivate investors’ collective buying and selling decisions. Many scholars have postulated a relationship between psychological processes, how investors buy and sell, and financial market price movements [2],[8],[6].

It has been only in the past decade that sophisticated experimental tools, such as functional magnetic resonance imaging (fMRI), have become available for examining this complex relationship. FMRI findings, when correlated with behavioral and affective (emotion) data, offer the opportunity to discern the fundamental neural processes that drive rational and irrational investor behavior. This article discusses implications of one aspect of the relationship between the brain and the financial markets – the brain’s “reward approach system” (reward system). Since the time of Aristotle in ancient Greece, scientists and philosophers have loosely hypothesized the existence of two major brain systems that are fundamental to almost all human behavior - the reward approach (pleasure-seeking) and the loss avoidance (pain-avoidance) systems [31].

When we perceive a potential reward in the environment, the brain’s system of reward approach motivation (reward system) is set into action. The reward system runs from the midbrain through the limbic system and ends in the neocortex. The neurons that carry information between the brain regions of the reward system are primarily dopaminergic. The reward system lies along one of the five major dopamine pathways in the brain, the meso-limbic pathway, which extends from the ventral tegmental area (VTA) at the base of the brain, through the nucleus accumbens (NACC) in the limbic system, to the gray matter of the frontal lobes [4] (e.g. the medial prefrontal cortex [MPFC]) (see figure 1). Dopamine has been called the “pleasure” chemical of the brain, because people who are electrically stimulated in the predominantly dopamine centers of the brain report intense feelings of well-being [11]. The dopaminergic pathways of the reward system are activated by illicit drug use, leading to street drugs being colloquially called "dope." The reward system coordinates the search for, evaluation of, and motivated pursuit of potential rewards.

Figure 1. A depiction of the reward system in a cross-section (sagittal

view) of the brain. The reward system

begins in dopamine neurons of the ventral tegmental area (VTA), passes through

the nucleus acumbens (NACC), and terminates in structures in the frontal lobes

such as the medial prefrontal cortex (MPFC).

The expectation of reward or loss is a guide to planning behavior. If we want to predict behavior, then it is necessary to measure how modifications of available information about potential rewards (and thus of reward expectations) alter subjects’ expectations and subsequent actions. If we can understand how cues from the environment stimulate the reward system, then we can understand how, and why, people are motivated to do many of the things, wise and unwise, rational and irrational, that they do. Investors are more likely to pursue rewards when they have strongly positive expectations of their activities. Investors are more likely to concentrate their cognitions on strategies for avoiding losses when they have strongly negative expectations. Reward approach and loss avoidance behaviors, when exhibited by large groups of consumers or investors, can and do impact the financial markets and the economy.

SPAN lab and the MID task

In the SPAN lab at Stanford University, Professor Brian Knutson and colleagues have been performing research into the structure and function of the reward system. The lab’s recent research involves the use of money to activate experimental subjects’ (usually Stanford students) neural reward systems. Money is rewarding and desired by all subjects, and it is easy to experimentally manipulate in terms of time delay to delivery, quantity (size), probability of delivery, and valence (monetary gain is rewarding while loss is punishing). In these experiments, subjects play a variation of a computerized game called the monetary incentive delay (MID) task [17] (see figure 2). In the MID task, subjects play repeated trials in which they make or lose money depending upon their ability to pay attention and react quickly.

Figure 2. The monetary incentive delay (MID) task with images and time

intervals.

Each of the basic MID trial begins with the presentation of a “cue” which informs the player of whether they are playing to make or lose money, and the amount of money at stake, during the forthcoming trial. Round cues designate that they are playing to make money (with no risk of monetary loss), and square cues indicate that they are playing to avoid loss (with no possibility of gain). After a randomized delay interval, a “target” (a solid white square) is presented. While the target is present on the computer screen, the subject must press a button. If the button is not pressed in time, the subject will either receive no gain or will lose money (depending upon the trial type). MRI scan slices are acquired at two-second TR intervals during each 6-second MID trial. Typically one image is taken during the anticipatory interval before the target, and one image is taken after the outcome is discovered.

The MID task has been designed for maximum stimulation of the reward system while minimizing extraneous cognitive interference. For example, each MID task trial lasts six to eight seconds. Trials of longer duration may lead to boredom and wandering thoughts (resulting in neural activations unrelated to monetary gain or loss). On the other hand, one weakness of the MID task is the lack of time allowed for reflection. No deliberation or choice between behavioral options is required in the basic task. Additionally, the scenario offered by the MID task is a very basic representation of financial incentives. Extraneous details have been minimized in the task design in order to maximize the neural effects. However, simplicity allows cue details to be systematically added to the basic task framework. A comparison of neural activations at each successive level of task complexity may be performed as cue information content increases.

Currently published experimental modifications of cue information include variations in outcome magnitude and valence. Recent modifications of the MID task include choice behavior and the addition of salient details such as probability and time delay to cue information. These recent results are currently unpublished, and there will be no discussion of the SPAN lab’s currently unpublished work in this paper.

By repeatedly giving subjects the opportunity to make or lose money during the short trials of the MID task, subjects' reward systems are repetitively activated in a challenging, attention-grabbing environment. Experimentally, increasing the magnitude (size) of a potential reward alters subjects' behavior, brain activations, and reported emotional states [19]. Additionally, changing the valence of the cue (playing to win versus playing not to lose) leads to strikingly different neural activations. When we multiply the effects of reward magnitude and probability variations, we get a picture of the effects of expected value - thought by many to be the prime motivator of all rational decision making [3]. Additionally, the roles of individual personality type (such as neuroticism and extraversion) on the reward system can be analyzed (unpublished), and several experimenters are currently scanning subjects in a simulated investment experiment.

There are many caveats regarding correlations between fMRI research findings and actual investor behavior (outside of the MRI magnet). Researchers are using controlled experimental settings, quite unlike the distraction-filled environments in which most investors function. Researchers are often examining behavior and brain activation over very short intervals (seconds to minutes), while most investors are making decisions over hours and days. Measures of affect (emotion) and preferences are taken after the trials. The brain activations of small groups of individuals may not be generalizable to the large masses of investors whose transactions fuel the financial markets. Yet the neural correlates of reward-pursuit behavior are universal, and our hope is that some useful lessons can be derived from the fMRI findings.

Activating the Reward System

Besides money, which is our primary experimental medium at SPAN lab, several experimental stimuli have been found to activate the brain’s reward system. Other activating stimuli include pleasant tastes [28], sexual images [16], attractive faces [1], sports cars [9], and money [5]. Remarkably, the anticipation of socially rewarding behaviors such as humor [24], altruism [30], and revenge [7] has also been found to activate the reward system. The above research demonstrates that regions of the reward system are aroused by subjectively “positive” expectations or rewarding activities of many varieties.

It has recently been found that receiving a preferred brand of a product such as soda (Coke versus Pepsi) [23] activates the MPFC. A preferred brand not only activates the same area of the brain as when experimental subjects win money, but the preferred brand of the product activates this area exclusively (non-preferred brands of the same product result in significantly less activation). These findings with brand preference are some of the impetus for the development of the business of “neuromarketing” – using neuroimaging to gauge brand quality and brand formation in experimental subjects. Using money in experiments we still haven’t found a way to reliably manipulate perceptions of familiarity, trust, or quality, as we can when comparing product brands or social relationships.

SPAN lab researchers have found that rewards activate the brain much differently than losses, both during anticipation and receipt. This indicates that the two system model of motivation (reward approach vs loss avoidance) may be accurate. Additionally, it may provide a neural basis for the differentiation of risk preferences, as described by prospect theory [14], in the realm of gains versus losses. SPAN lab researchers have additionally found that the anticipation of receiving monetary rewards primarily activates the NACC, while receiving or enjoying a reward activates the MPFC [18] (See figure 3). This differentiation of anticipation versus outcomes may correlate with the difference between behavior planning (anticipation) and learning or updating (outcome). Since security pricing is theorized to be based on investors’ future expectations, an analysis of how changes in expectations alter neural activations and behavior may contribute to a new theory of security pricing.

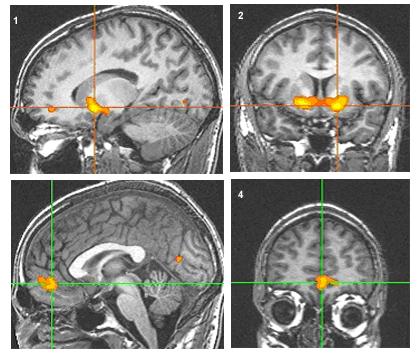

Figure 3. Top: The nucleus accumbens (NACC) is activated when a monetary, food,

sexual, luxury, or other reward is anticipated. The nucleus accumbens (NACC) is activated in these sagittal (1)

and coronal (2) images by the anticipation of monetary reward. Bottom:

The medial prefrontal cortex (MPFC) is activated when a preferred brand

is seen or when a reward is received.

The medial prefrontal cortex is activated in these sagittal (3) and

coronal (4) images.

Further experimentation has revealed that anticipation of increasing reward magnitude increasingly activates the NACC [19], while increasing reward outcomes increasingly activate the MPFC [20]. Larger reward magnitude is correlated with more positive reported affect (emotional state) in post-experiment questionnaires. Additionally, the assessment of reward probabilities may occur in the prefrontal cortex (MPFC), according to others’ findings [13].

It is important to note that the magnitude (size) of a potential reward is particularly influential on the motivational, limbic, and emotional area of the brain – the NACC. That is, we feel excited by big rewards, our level of impulsivity increases, and sometimes we just can’t help ourselves from doing whatever it takes to get them. Additionally, the level of NACC activation decreases after reward outcome to a level either slightly below baseline (if the anticipated reward is received) to significantly below baseline (if the anticipated reward is not received). This indicates that levels of excitement may wane to a significant degree following rewarding outcomes.

Arousal, Affect, and Rewards

Unpublished data indicates that personality plays a role in reward processing as well. A poster at the 2004 Cognitive Neuroscience conference in San Francisco (Cohen and Ranganath, 2004) demonstrated that extraversion increases NACC activation during reward anticipation. Subjects who score highly in extraversion and low in neuroticism have significantly higher NACC activation when anticipating rewards than individuals who score low in extraversion and high in neuroticism. This is similar to data presented by Dr. Helen Mayberg at the 2004 Wisconsin Health Emotions conference on the role of personality type and psychiatric disorders during reward processing (unpublished).

It has been demonstrated that subjective reports of arousal

correlate with increased NACC activation [23].

One Austrian researcher found that physical arousal, probably related to

reward system activation, correlates with a greater willingness to spend money

while experimental subjects are shopping [10].

Others researchers have found that investors’ emotions correlate with

future stock market direction, also a telltale sign of reward system involvement

in group buying and selling behavior.

As of yet, based on the available research, there is no sure way to

predict, only to describe, consumer and investor behavior. However, there are interesting and important

correlations that follow.

There are many potential applications of reward system research to investing and the financial markets. Personality traits, gender, and age play a role in reward pursuit characteristics. The receipt of rewards activates the MPFC, a different neural system from reward anticipation. Adolescents and young adults may be more susceptible to investment frauds due to a relative overactivity of their impulse-driving NACCs and a lack of experience to inhibit their impulses via the judgment activity of the prefrontal cortices.

Good Moods and Booming Markets

Traditional finance theory assumes that financial markets are efficient (there exist no arbitrageable price patterns) and that market participants make rational decisions based on the best available information. Recent research has revealed both the existence of price patterns in the markets (“anomalies” according to traditional theory) and evidence of irrational investor decision-making. Several market price anomalies appear related to collective shifts in investors’ moods, from risk-taking and reward seeking to risk-averse and loss-avoidant. Additionally, the few available studies on real-time investor behavior suggest that affect states are correlated with irrational buying and selling behavior.

Financial market price anomalies are often attributed to psychological

biases and heuristics of investors that lead to collective mis-behavior in

the markets. Investor biases such

as overconfidence, narrow framing, optimism, and mis-attribution have been

modelled as the primary biases affecting financial market prices.

In the past five years, several studies have directly identified affective

factors as the likely causes of large anomalies in financial prices.

Affect may influence investing behavior through behavioral conformity,

creating a diversity breakdown. One

important anomalous finding involves the role of cloud cover, as a proxy for

negative mood-states, on reducing purchasing behavior. Hirshleifer and Shumway, in a 2001 paper entitled

Good day sunshine: Stock returns

and the weather found that cloud

cover in the city of a country’s major stock exchange is correlated with low

daily stock index returns in 18 of 26 national exchanges [12]. The authors examined 26 stock market indices around the globe for the period of 1982

– 1997. In New York City a 24.8% annual

return was earned if the hypothetical portfolio was invested only on days

forecast to be cloudless; this is versus a 8.6% average return on days with

cloud cover. The authors provide extensive evidence that

sunshine improves market participants moods (affect), and may thus collectively

increase their willingness to take risk.

Kamstra, Kramer, and Levi, in a 2000 paper Losing sleep at the market: The daylight savings anomaly, show that disrupted sleep patterns after transitions to and from daylight savings time are related to stock returns [15]. In a year 2000 working paper Winter blues: Seasonal affective disorder (SAD), the January effect, and stock market returns, Kamstra, Kramer, and Levi find that stock returns are significantly related to season, and they suggest that deterministic variations in the length of day contribute to this finding via their actions on mood (affect). Temperature deviations also correlate with stock price movements in many countries around the globe according to professors Cao and Wei in the 2002 SSRN working paper Stock Market Returns: A note on the temperature anomaly. The authors hypothesized that the temperature corrlelations with stock market price movements occur via effects on mood (affect) and subsequent investing behavior. Additionally, lunar cycles are related to market performance as reported by authors Yuan, Zheng, and Zhu in the working paper Are Investors Moonstruck: Lunar phases and stock returns. Researchers from the Federal Reserve Bank of Atlanta, A. Krivelyova and C. Robotti, in the 2003 SSRN working paper “Playing the Field: Geomagnetic Storms and International Stock Markets”, correlated strong geo-magnetic storms with world stock market underperformance during the two weeks following the storms. The authors noted that the psychology literature demonstrates a correlation between strong geo-magnetic storms and signs of depression in the general population over the following two weeks. Seasonal and weather factors contribute to conformity in investor behavior and price anomalies via changes in affect according to these authors.

Research into the biological basis of investor behavior has been limited. Andrew Lo and Dmitry Repin a MIT enrolled traders in a study of real-time psychophysiological measurements during intra-day trading [21]. Of the ten traders studied, Lo and Repin found that their physiological reactions (measured by SCR and BVP) were correlated with periods of market volatility, and less experienced traders had significantly greater physiological reactivity to market volatility than their more experienced colleagues. The authors concluded, “Contrary to the common belief that emotions have no place in rational financial decision-making processes, physiological variables associated with the autonomic nervous system are highly correlated with market events even for highly experienced professional traders.”

Investors who can’t get enough

Activation of the reward system results in particular types of behavior and emotion, characterized among investors as greater risk-taking, increased impulsivity, enhanced positive feelings, and greater physical arousal. Loss avoidance behavior and emotions are timid, protective, fearful, and risk-averse. When activated among large groups, reward approach behavior can impact the economy as a whole, leading to stock market bubbles, increased consumer purchasing, higher investment risk-taking, and an increased use of credit. Loss avoidance, on the other hand, is seen when people decrease borrowing, sell off assets, and report decreased financial confidence (and even fear).

Expectations of the future drive investment behavior according to the standard financial models of asset pricing [25]. Yet there are deep implications for asset pricing theory if expectations are generated by a hedonic process. If anticipation of reward activates the NACC during financial market experiments, then it is plausible that expectations are both hedonic (leading to positive affect) and arousal inducing (leading to more impulsive investing behavior). These are not characteristics of a “rational investor.” It is very likely that investors will feel increased impulsivity and excitement when identifying investment opportunities (potential rewards). For example, can you think of any situations in which the prospect of getting a large financial reward, say from an investment, has made you feel excited and impulsive? Most investors report this experience, particularly when the potential pay-off appears close at hand or easy to obtain. The danger is that making decisions with an affective (emotional) bias often leads to irrational decision-making and financial loss.

The case of overconfidence is an excellent systematic example of irrational investing. Overconfidence is an investing bias associated with overtrading [26] and decreased profitability (according to B. Biais and colleagues in a 2002 unpublished manuscript entitled "Psychological Disposition and Trading Behavior"). Overconfidence is more common among men than women, more common among the young than the old [27]. Unpublished data, presented in a poster session of the 2004 Cognitive Neuroscience conference, indicates that extraverted individuals have more NACC activation during reward anticipation than others. If extraversion might describe a one aspect (social) of overconfidence, then we might also expect to see greater NACC activation during financial reward anticipation by extraverts. It is important to find robust neural correlates of biases such as overconfidence among traders and investors, in large part because of the lack of self-awareness and decreased profitability suffered by these individuals. It is a positive feedback cycle – the more money investors make, the more money they think they can make, and their sense of all-consuming excitement, and impulsive trading often go into overdrive. This “overdrive” is also related to the addictive nature of day-trading, and day-trading addiction is a not an uncommon problem.

Investors tend to overconfidently chase performance, and most of the new mutual fund cash inflows go into the past top-performers, such as 4 and 5-star-ranked mutual funds. But putting money into top-performing funds is typically harmful to investors who do so. DALBAR and Bogle financial center report that from 1982 to 2002 the average mutual fund investor made an average annual return of approximately 2.4%, the average mutual fund appreciated 10.2% annually, and the S&P 500 increased 12% annually [32]. The presumed cause of this type of individual investor underperformance is (1) chasing the top-performers (due to overconfidence in one’s own decision-making capabilities) and (2) overtrading. What neural processes induce investors to chase performance and impulsively overtrade? It may be a result of NACC activation, during the anticipation of large rewards, that stimulates this behavior.

In addition to individual investor correlations, there are many potential applications of fMRI research to understanding price anomalies (inefficiencies) in the financial markets. Try to think of what attracts our attention in the markets, and you will probably think “superior past performance,” “a good-looking chart,” “good number such as sales growth,” etc… What typically attracts our attention is superior past performance, even though paying attention to past performance counter-intuitively leads to inferior future results. Superior past performance is often inversely correlated with future returns (especially over the long-term) as illustrated by another example from Bogle financial center and Lipper Inc. These researchers found that of the top ten performing mutual funds (out of a total sample of 851) from 1996-1999, those top ten funds were all in the bottom decile of performance out of the same sample of 851 from 1999-2002 [32]. A market pattern that appears to be due to NACC activation and its influence on collective investor behavior is the “buy on the rumor sell on the news pattern [29].”

Discussion

This article has primarily been about brain-imaging studies of the brain’s reward system. A few speculative correlations with the financial markets and investing behavior have been included. The role of the NACC and its idiosyncrasies in motivating reward pursuit have implications for phenomena far outside of the laboratory. Hubris and overconfidence may themselves be psychological functions of the MPFC, while impulsivity and motivated excitement may be rooted in the NACC. Economic booms, fueled by risk-taking and reward seeking investors, and economic busts, exacerbated by risk-averse and loss-avoidant investors, are a fact of the economic cycle that touches all of us. FMRI may hold the promise of revealing what information drives risk-taking and risk-avoidant behavior, and what we can do to smooth the disruptions of economic and market cycles. At the close of this article we postulated correlations between neural processes we observe in the laboratory and anomalous price patterns observed in the financial markets. As we begin to understand more about how ranges of reward magnitudes, memories, probabilities, and delays affect the reward system, we may find more fascinating correlations in collective behavior and non-rational financial decision-making.

References

[1] I. Aharon,

N. Etcoff, D. Ariely, C.F. Chabris, E. O'Connor, H.C. Breiter. Beautiful

faces have variable reward value: fMRI and behavioral evidence. Neuron, 32(3), (2001) 537-51.

[2] N. Barberis, A. Schleifer, & R. Vishny. A model of investor sentiment. Journal of Financial Economics, 49 (1998) 307-343.

[3] D. Bernoulli. Specimen Theoriae Novae de Mensara Sortis, Commentarii Academiae Scientiarum Imperialis Petropolitanae, 1738. (trans. in 1954, Econometrica).

[4] M.A. Bozarth. Pleasure systems in the brain. In D.M. Warburton (ed.), Pleasure: The politics and the reality (pp. 5-14 + refs). John Wiley & Sons, New York, 1994.

[5] H.C. Breiter, I. Aharon, D. Kahneman, A. Dale, P. Shizgal. Functional imaging of neural responses to expectancy and experience of monetary gains and losses. Neuron. 30(2), (2001) 619-39.

[6] K. Daniel, D. Hirshleifer & A. Subrahmanyam, A. Investor psychology and security market under- and overreactions. Journal of Finance, 53 (1998) 1839-1886.

[7] D.J. de Quervain, U. Fischbacher, V. Treyer, M. Schellhammer, U. Schnyder, A. Buck, E. Fehr. The neural basis of altruistic punishment. Science 305, (2004) 1254.

[8] D. Dremen & E. Lufkin. Investor overreaction: evidence that its basis is psychological. Journal of Psychology and Financial Markets, 1 (2000) 61-75.

[9] S. Erk, M. Spitzer, A.P. Wunderlich, L. Galley, H. Walter. Cultural objects modulate reward circuitry. Neuroreport. 13(18), (2002) 499-503.

[10] A. Gröppel-Klein, D. Baun. The Role of Customers’ Arousal for Retail Stores – Results from An Experimental Pilot Study Using Electrodermal Activity as Indicator, in: M. C. Gilly and J. Meyers-Levy (eds.): Advances in Consumer Research, Vol. XXVIII Valdosta, GA: Association for Consumer Research, (2001) 412-419.

[11] R.G. Heath. Pleasure response of human subjects to direct stimulation of the brain: Physiologic and psychodynamic considerations. In R.G. Heath (ed.), The Role of Pleasure in Human Behavior (pp. 219-243). Hoeber, New York, 1964.

[12] D. Hirshleifer and T. Shumway. “Good Day Sunshine: Stock Returns and the Weather.” Journal of Finance 58, (2003) 1009-1032.

[13] J. Hornak, J. O'Doherty, J. Bramham,

E.T. Rolls, R.G. Morris, P.R. Bullock, C.E. Polkey. Reward-related reversal

learning after surgical excisions in orbito-frontal or dorsolateral prefrontal

cortex in humans. J Cogn

Neurosci. 16(3), (2004) 463-78.

[14] D. Kahneman and A.Tversky. Prospect Theory: An Analysis of Decision Under Risk. Econometrica, 47, (1979) 263-292.

[15] M.J. Kamstra, L.A. Kramer, & M.D. Levi. Losing sleep at the market: The daylight savings anomaly. American Economic Review, 90, (2000) 1005-1011.

[16] S. Karama, A.R. Lecours, J.M. Leroux, P.

Bourgouin, G. Beaudoin, S. Joubert, M. Beauregard. Areas of brain activation

in males and females during viewing of erotic film excerpts. Human Brain Mapp. 16(1), (2002) 1-13.

[17] B. Knutson, A. Westdorp, E. Kaiser, & D.

Hommer. FMRI visualization of brain activity during a monetary incentive delay

task. NeuroImage, 12, (2000), 20-27.

[18] B. Knutson, G. Fong, C.M. Adams, & D. Hommer. Dissociation of reward anticipation versus outcome with event-related FMRI. NeuroReport, 12, (2001) 3683-3687.

[19] B. Knutson, C.S. Adams, G.W. Fong, & D. Hommer,

D. Anticipation of monetary reward selectively recruits nucleus accumbens.

Journal of Neuroscience, 21:RC159 (2001).

[20] B. Knutson, G.W. Fong, S.M. Bennett, C.S. Adams, & D. Hommer. A region of mesial prefrontal cortex tracks monetarily rewarding outcomes: Characterization with rapid event-related fMRI. NeuroImage, 18, (2003) 263-272.

[21] A. Lo & D. Repin. The Psychophysiology of Real-Time Financial Risk Processing. Journal of Cognitive Neuroscience 14, (2002) 323-339.

[22] A. Lo. “The Adaptive Markets Hypothesis: Market Effciency from an Evolutionary Perspective.” Journal of Portfolio Management. 30 (2004) 15-29.

[23] S.M. McClure, J. Li, D. Tomlin, K. S. Cypert, L.M. Montague, and P.R. Montague. Neural Correlates of Behavioral Preference for Culturally Familiar Drinks. Neuron, 44, (2004) 379–387.

[24] D. Mobbs, M.D. Greicius, E. Abdel-Azim, V. Menon, A.L. Reiss. Humor modulates the mesolimbic reward centers. Neuron, 40(5), (2003) 1041-8.

[25] J.F. Muth. Rational Expectations and the Theory of Price Movements (1961), reprinted in The New Classical Macroeconomics, 1, (1992) 3-23 (International Library of Critical Writings in Economics, vol. 19. Aldershot, Elgar, London, (1992).

[26] T. Odean & B. Barber. The Courage of Misguided Convictions: The Trading Behavior of Individual Investors. Financial Analyst Journal, (1999), 41-55.

[27] T. Odean & B. Barber. Boys will be Boys: Gender, Overconfidence, and Common Stock Investment. Quarterly Journal of Economics, 116, 1, (2001) 261-292.

[28] J. P. O’Doherty, R. Deichmann, H. D.

Critchley, R. J. Dolan. Temporal difference models and reward-related

learning in the human brain. Neuron,

38 (2003) 329-337.

[29] Peterson,

R. "Buy on the Rumor:” Anticipatory affect and investor behavior. Journal of Psychology and Financial Markets,

3, 4, (2002).

[30] J. Rilling, D. Gutman, T. Zeh, G. Pagnoni, G. Berns, C. Kilts. A neural basis for social cooperation. Neuron, 35(2), (2002) 395.

[31] H. Spencer. Principles of Psychology. Appleton Press: New York, 1880.

[32] “The law of averages.” The

Economist. July 3, 2003.